India’s credit landscape is undergoing a transformation, primarily driven by its youthful population. According to TransUnion CIBIL’s August 2024 report titled Empowering Financial Freedom: The Rise of Credit Self-Monitoring in India, an impressive 77% of the 119 million consumers actively monitoring their credit belong to Gen Z and millennials. The report sheds light on the credit behaviors of these self-monitoring individuals—those who have taken the initiative to review their CIBIL score and report at least once with TransUnion CIBIL—revealing their significant role in shaping the country’s credit revolution.

TransUnion CIBIL stands as one of the top credit information agencies in India, responsible for maintaining the credit scores of individuals and borrowers nationwide. Although TransUnion CIBIL refers to its score as the CIBIL score, other credit bureaus also provide similar credit scoring systems under different names.

Young borrowers are becoming increasingly credit-conscious.

The report highlights a noticeable change in credit behavior among Gen Z and millennials, signifying a shift in how these generations manage their finances. Rajesh Kumar, Managing Director and CEO of TransUnion CIBIL, stated that this early engagement with credit suggests these younger generations will have a major influence on the future of India’s consumer credit landscape. By adopting credit practices earlier in life, young Indians are acknowledging the value of building a solid credit history, positioning themselves for long-term financial stability, he further noted.

India’s credit awareness

India’s credit awareness is on the rise, with an impressive 119 million people actively tracking their CIBIL scores as of March 2024. The report highlights a notable year-on-year growth of 51 percent in credit profile monitoring during 2023-24, which translates to an additional 43.6 million individuals taking a more engaged approach to managing their credit. This uptick reflects a broader trend toward greater financial literacy and accountability among consumers.

One key factor behind this surge in credit score awareness is the widespread availability of digital tools, which have made it much easier for people to access, understand, and monitor their credit scores. Those who actively keep an eye on their scores tend to maintain healthier credit, with a 17-point average difference (729 vs. 712) compared to those who don’t monitor their scores. This clearly illustrates the correlation between credit engagement and better financial standing.

Having a good credit profile can open doors to a variety of advantages, such as faster loan approvals, lower interest rates, personalized financial products, and higher credit limits. By practicing responsible credit behaviour, individuals can enjoy these benefits and gain greater financial freedom and flexibility.

Breaking down the 119 million self-monitoring consumers

Breaking down the 119 million self-monitoring consumers reveals interesting patterns in credit behavior. Of those who checked their credit scores in the financial year ending March 2024, 28 percent are individuals aged 25 or younger. However, the largest group of credit score checkers is found among those aged 26 to 35. The higher representation of this age group points to a growing focus on establishing and maintaining credit awareness early, as young adults take conscious steps to safeguard their financial well-being over time.

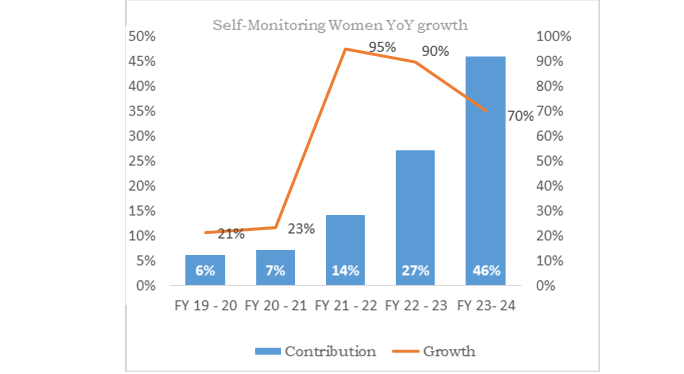

The report also shows a clear gender disparity in credit monitoring, with men making up 82 percent of self-monitoring consumers and women accounting for only 18 percent (see graphic). Although the gap between male and female participation is still wide, the increasing number of women engaging in credit monitoring is a positive sign. It reflects a broader trend of financial empowerment and involvement among women, signaling their growing presence in financial decision-making and credit management.

Monitoring credit score

Monitoring credit scores leads to notable improvements in financial health. According to the findings, 46 percent of individuals who regularly checked their credit scores experienced an increase in their scores shortly after. This improvement rate is higher than the 41 percent seen among those who do not monitor their scores, highlighting a growing awareness of credit in India. For borrowers, enhanced credit scores translate into advantages like better interest rates and higher credit limits.

Additionally, the report indicates a strong link between monitoring credit scores and the ability to open new credit lines. Self-monitoring consumers showed an impressive sixfold increase in the number of new credit lines opened within three months of checking their scores, compared to those who did not engage in score monitoring. This underscores the positive impact of proactive credit management on financial opportunities.

Among self-monitoring consumers, personal loans emerged as the most favored credit product within three months of score monitoring, closely followed by consumer durable loans and loans secured against gold or jewelry.

Additionally, the data reveals that 44 percent of consumers are taking an active role in managing their credit health by checking their CIBIL score and credit report at least four times over a 12-month span.

Women Borrower

As women become more knowledgeable about the implications and potential of credit, India’s credit market is experiencing a notable rise in informed female borrowers. The report highlights a striking 70 percent increase in women who are actively monitoring their credit, reflecting a significant trend toward enhanced financial planning and proactive credit management.

Additionally, in the financial year 2023-24, 61 percent of women consumers achieved a CIBIL score of 730 or above, showcasing their dedication to maintaining strong credit health and seizing better financial opportunities.

Conclusion

The evolving credit landscape in India reflects a growing awareness and proactive engagement among young and female borrowers. As these demographics increasingly embrace credit monitoring, they not only enhance their financial stability but also contribute to a more informed and responsible credit culture nationwide. This trend signals a promising shift towards greater financial empowerment for all consumers.

(Source – Transunion CIBIL)