Soon, the cheques you deposit at your bank branches will be cleared on the same day. Currently, deposited cheques are collected and processed in batches at designated times throughout the day, resulting in a settlement cycle that can take up to two working days (T+2). This extended waiting period creates a longer settlement timeframe and increases the potential risk for both parties involved.

What It Means for Customers

Currently, cheque clearing using the Cheque Truncation System (CTS) operates on a batch processing basis, resulting in a clearing cycle that can take up to two working days. To enhance the efficiency of cheque clearing, minimize settlement risk for participants, and improve customer experience, the Reserve Bank of India (RBI) Governor has proposed transitioning the CTS method from batch processing to continuous clearing.

Although the importance of cheques is diminishing in an era dominated by UPI (Unified Payments Interface), NEFT (National Electronic Funds Transfer), and RTGS (Real-Time Gross Settlement), they still serve as a vital payment method. The reduction in clearing time will significantly improve customer experience and lessen the risks associated with delayed settlements, as noted by the RBI Governor.

What is the Cheque Truncation System?

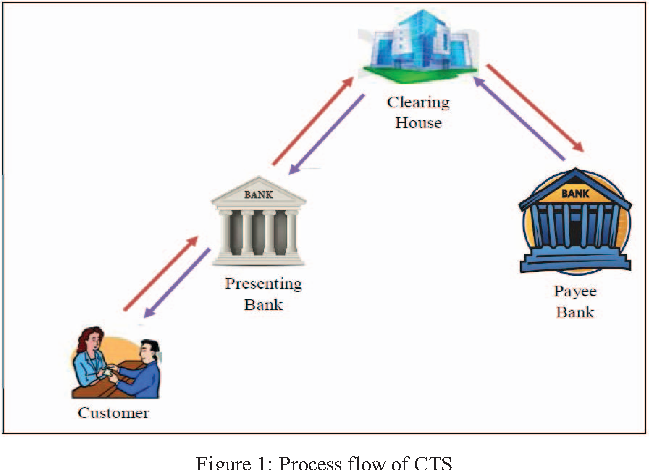

The Cheque Truncation System (CTS) is a cheque clearing system managed by the Reserve Bank of India (RBI). As the term suggests, truncation refers to the process of halting the physical flow of cheques during the clearing process. Instead of physically transporting the cheques, an electronic image of each cheque is captured and transmitted, along with key data.

This system eliminates the need to move physical cheques between branches, thereby reducing the associated costs of transporting them and minimizing the time needed for their collection. Additionally, it streamlines and enhances the overall cheque processing experience. CTS was first introduced and implemented on a pilot basis in the National Capital Region (NCR) in February 2008.

Benefits to Account Holders

With no physical movement of cheques, account holders no longer need to worry about the possibility of cheques being lost in transit. Utilizing CTS cheques allows for faster clearance, a shorter clearing cycle, and quicker crediting to your account. As proposed by the RBI Governor, depending on whether the cheque is local or outstation, it may now be cleared on the same day.

One of the most significant advantages is that CTS-compliant cheques offer enhanced security and are less susceptible to fraud.

What is the Positive Pay System for Cheques?

The Positive Pay System (PPS) for Cheque Truncation System (CTS) is an additional feature provided by the National Payments Corporation of India (NPCI) to all banks, aimed at facilitating the clearing process and preventing cheque-related fraud. It is part of the prudent practices that banks follow for payment processing. This system has been introduced to enhance customer safety in cheque payments and to minimize instances of fraud that may arise from the tampering of cheque leaves.

Banks have been instructed to offer the PPS facility to all account holders who issue cheques for amounts of ₹50,000 and above. While using this facility is optional for account holders, banks may consider making it mandatory for cheques of ₹5,00,000 and above.

If a customer wishes to view the physical cheque they have issued for any reason, several options are available. Under the CTS, physical cheques are retained at the presenting bank and do not transfers to the paying bank. If requested, banks can provide images of the cheques that are certified or authenticated. However, if a customer wants to see or obtain the actual physical cheque, they must request it from their bank, and there may be associated costs for this service. To comply with legal requirements, presenting banks that truncate cheques are required to retain the physical instruments for a period of 10 years.

Conclusion

The upcoming changes to cheque clearing processes in India herald a new era of efficiency and security for account holders. With the shift from batch processing to continuous clearing under the Cheque Truncation System, customers can anticipate same-day clearance of cheques, significantly enhancing their banking experience. Coupled with the Positive Pay System, which adds an extra layer of security against fraud, these developments demonstrate the Reserve Bank of India’s commitment to modernizing payment systems. While digital payment methods continue to gain prominence, cheques remain a vital tool for many, and these enhancements will ensure they remain secure and reliable.