India’s banking sector is at a potential turning point, with policymakers revisiting a sensitive and long-standing debate should foreign investors be allowed to own larger

India’s financial regulator, the Reserve Bank of India (RBI), is tightening its grip on treasury operations and derivative exposures in private and foreign banks. This

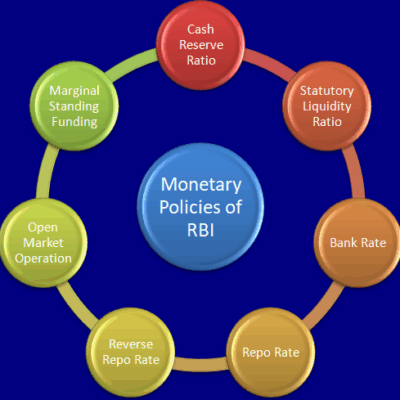

In a strategic move to bolster the effectiveness of its monetary policy, the Reserve Bank of India (RBI) is taking deliberate steps to revive the

The Reserve Bank of India (RBI), in its latest monetary policy review, has reduced the repo rate—a move that directly impacts the borrowing costs in

In a welcome move aimed at offering more flexibility and clarity in estate planning, Indian banking regulations have undergone a key update: individuals can now

In a significant regulatory intervention aimed at maintaining the financial stability of the microfinance sector, the Reserve Bank of India (RBI), in January 2025, revised

In a significant regulatory move, the Reserve Bank of India (RBI) has directed all banks to take proactive measures to streamline the activation of inoperative

In a move to promote digital payments and make transactions faster and more accessible, the Reserve Bank of India (RBI) has raised the limits for

The Reserve Bank of India (RBI) recently decided to keep the repo rate steady at 6.5% for the 10th consecutive time during its bi-monthly Monetary

Soon, users of the Unified Payments Interface (UPI) will have the option to authorize someone else to perform UPI transactions on their behalf using their