With digital payments transforming the way Indians transact, it’s no surprise that tech platforms like Google Pay are stepping into the lending space. Google Pay,

Whether you’re planning a wedding, funding higher education, expanding a business, or handling a sudden emergency, borrowing money can be a necessary financial step. In

In a significant move to enhance cybersecurity and streamline regulatory processes within India’s banking sector, the Reserve Bank of India (RBI) has implemented two pivotal

In India, personal loans have become a crucial financial tool for individuals seeking funds for various purposes, such as weddings, medical emergencies, or travel. When

Depositing cash into a savings account is a routine financial activity. However, in today’s increasingly digitised and regulated financial environment, depositing large sums of cash

Introduction: A New Era in Digital Payments The Indian payment landscape has transformed drastically in the past five years. From the dominance of debit cards

Whether it’s an unexpected medical bill, urgent travel, or last-minute wedding expenses, financial emergencies don’t always wait for your next pay check. That’s where small

As of March 2024, a staggering ₹78,213 crore lies unclaimed in bank accounts across the nation, according to the Reserve Bank of India’s (RBI) annual

In a significant move to simplify banking transactions, leading banks like Bank of Baroda and Axis Bank have introduced the UPI-enabled Interoperable Cash Deposit (ICD)

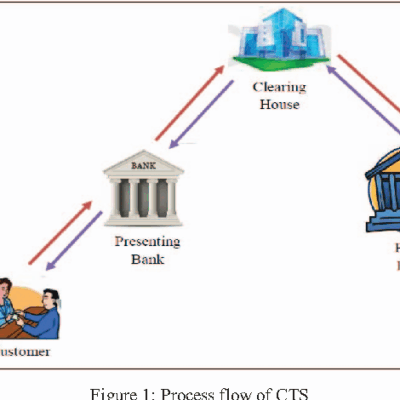

Soon, the cheques you deposit at your bank branches will be cleared on the same day. Currently, deposited cheques are collected and processed in batches