At its 54th meeting held in New Delhi on September 9, the Goods and Services Tax (GST) Council decided to include the renting of commercial

The GST Council is expected to discuss a proposal to impose an 18% Goods and Services Tax (GST) on payment aggregators (PAs) for facilitating small-value

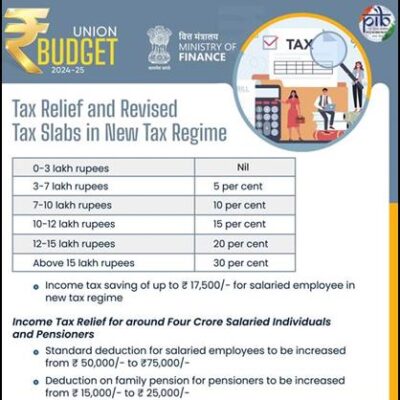

Taxes play a crucial role in our personal financial journeys. Up until 2020, taxpayers had only one option for filing their taxes, known as the

If you receive a GST demand order, you have the option to either appeal the order or pay the demanded amount. However, GST officials have

While the online gaming sector anticipates a re-evaluation of the 28% goods and services tax (GST) imposed on it, the GST Council is not expected

GST has been a boon for sports goods makers in West UP, while pharma is struggling The outskirts of Meerut host a thriving sports goods

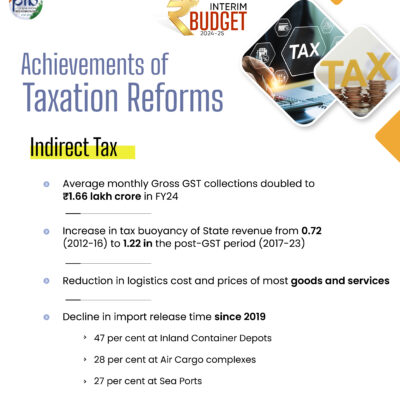

In the intricate realm of taxation in India, the Goods and Services Tax (GST) emerges as a noteworthy initiative aimed at streamlining the indirect tax

As anticipated, Finance Minister Nirmala Sitharaman did not introduce any income tax rebates. The Indian middle class has no cause for celebration, as no tax

News 1 – FM Nirmala Sitharaman proposes GST Council to consider raising the threshold from ₹40 lakh to ₹60 lakh Finance Minister Nirmala Sitharaman addressed

Launching or running a small business in India is no easy feat. Apart from chasing growth, managing vendors, and pleasing customers, entrepreneurs must also navigate