Taxes play a crucial role in our personal financial journeys. Up until 2020, taxpayers had only one option for filing their taxes, known as the old regime. However, in the Union Budget 2020, the government introduced a new tax regime. This new regime aimed to simplify the tax process by offering lower tax rates but included fewer deductions.

As of 2024, the new tax regime, characterized by its streamlined process and fewer deductions, has become the default option for tax filing. In contrast, the old regime, which offers multiple deductions, is still available but is no longer the default choice. In this scenario, it is vital for taxpayers to assess which regime aligns best with their financial goals and provides the most advantages. To make an informed decision, it is essential to have a comprehensive understanding of the deductions, allowances, and exemptions offered under each regime.

The old regime currently provides a variety of deductions under different sections of the Income Tax Act to assist taxpayers in reducing their taxable income and overall tax liability. Among these is the well-known Section 80C, which includes deductions for insurance premiums, investments such as the Public Provident Fund, Equity-Linked Savings Schemes, Employee Provident Fund, children’s education fees, and home loan principal repayments, among others. Taxpayers can also avail deductions and exemptions for medical insurance premiums under Section 80D, interest on education loans under Section 80E, donations to charitable institutions under Section 80G, and interest on home loans under Section 24, to mention a few.

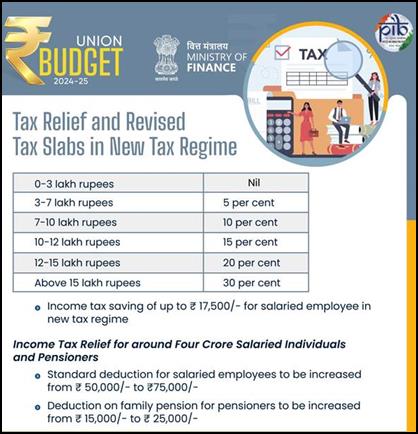

Regarding the new tax regime, it provides lower tax rates but with fewer deductions and exemptions compared to the old regime. Here’s an overview of the deductions available under the new tax regime as of 2024.

- The Budget 2024 introduced a Rs.25,000 increase in the standard deduction under the new regime, raising the limit to Rs.75,000 from the previous Rs.50,000. This benefit will be available to all taxpayers opting to file their taxes under the new regime.

- The new regime sets the basic exemption limit at Rs.3 lakh, meaning income up to this amount will not be subject to tax.

- Individuals with a taxable income of up to Rs.7 lakh may qualify for a rebate equivalent to their payable income tax on taxable income or Rs.25,000, whichever is lower.

- The maturity amount from a life insurance policy, where the premium is up to 10% of the policy sum assured amount, will be tax-exempt. For example, if you have an endowment policy with an annual premium of Rs.23,500 and a sum assured of Rs.25 lakh, and the maturity amount is Rs.28 lakh, the premium is less than 10% of the sum assured, thus the maturity amount received will be tax-free.

- Amounts up to Rs.5 lakh received under the Voluntary Retirement Scheme will not be taxed.

- Under the new tax regime, gratuity payments up to Rs.20 lakh from your employer will be tax-exempt.

- Taxpayers can claim daily allowances received while on tour or transfer as a tax deduction. For example, if an individual goes on a 5-day business trip and receives a daily allowance of Rs.1,000 from their employer, they can claim a reimbursement of Rs.5,000 (Rs.1,000 x 5 days) tax-free.

- Similar to daily allowances, taxpayers can claim up to Rs.1,600 per month for transport expenses. For instance, if an individual receives Rs.1,500 per month for commuting, they can claim an annual amount of Rs.18,000 (Rs.1,500 x 12 months) as a tax deduction.

- Specially-abled taxpayers can claim transport allowances, up to a certain amount, as a tax deduction. For example, a specially-abled individual receiving Rs.3,000 per month as a travel allowance can claim Rs.36,000 (Rs.3,000 x 12 months) as a tax deduction.

- Individuals incurring travel expenses while on an official tour or transfer can claim such expenses without incurring tax. For instance, if an employee goes on a work tour and incurs a travel expense of Rs.700 per day for 7 days within the city and is reimbursed Rs.4,900 by their employer, this reimbursement will be tax-free for the individual.

Conclusion

Navigating the intricacies of the tax system is crucial for maximizing your financial benefits and achieving your financial goals. As of 2024, taxpayers must choose between the new default tax regime, with its streamlined process and lower tax rates but fewer deductions, and the old regime, which offers a plethora of deductions and exemptions. Understanding the specific deductions, allowances, and exemptions available under each regime is essential for making an informed decision that aligns with your personal financial situation.

(Source – PIB)